Throughout 2016 we achieved real positive impacts in the communities where we work – be it making transport infrastructure more resilient to the effects of climate change, introducing higher standards to municipal waste management, or achieving significant emission reductions through increasing residential and industrial energy efficiency.

Impact

As our updated transition approach attests, we go beyond providing finance for projects in the hope that, at some point, end‐users will benefit. The potential impacts of EBRD projects for businesses, wider communities and the environment are assessed right from the start so we can be confident that the benefits of an EBRD project will stretch as far into the future as possible.

In this chapter

GREEN ECONOMY TRANSITION

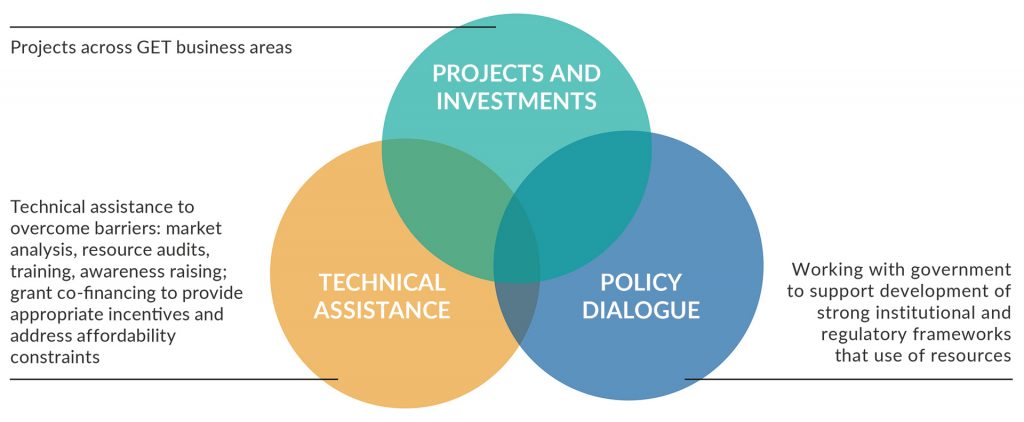

In 2016 we stepped up the Bank’s contribution and commitment to climate finance with the first full year of our Green Economy Transition (GET).

Over the years, the importance awarded to aspects of the green economy in the Bank’s work has increased, reflecting both the priorities of the EBRD countries of operations, as well as the growing attention to environmental sustainability internationally. GET is based on the EBRD’s existing business model and strong track record while aiming to further increase its impact. Previous sustainability and efficiency initiatives are now under the GET umbrella.

The GET approach seeks to increase the volume of green financing from an average of 24 per cent of EBRD annual business investment in the 10 years up to 2016 to 40 per cent by 2020.

In 2016, projects signed under the GET approach accounted for €2.9 billion via 151 transactions, representing 33 per cent of total Annual Bank Investment (ABI). These should reduce annual CO2 emissions by 5.2 million tonnes and create an energy saving of 29 million gigajoules or 694 kilotonnes of oil equivalent.

The GET approach enhances our sustainability work in several important ways.

- Broadening the environmental dimension: up until 2016, the EBRD’s green finance covered important areas such as climate change mitigation and adaptation as well as resource efficiency. To further integrate other relevant areas of a green economy, the protection of natural assets – such as investments whose primary purpose is the prevention of pollution or remedying damage to ecosystems – are included from 2016.

- Emphasising innovation: there is considerable potential to increase the take-up of clean hi-tech solutions and innovative processes with environmental benefits in the EBRD region. The GET brings suppliers of new technologies and equipment into the markets, for example through the use of technology transfer mechanisms, such as the EBRD’s Finance and Technology Transfer Centre for Climate Change.

- Maximising impact: by making selective use of public delivery channels. Recognising the large scope for investments with environmental benefits in the public sector, for instance in public buildings, the GET uses a broad range of financing channels and capacity-building tools to support innovative public ventures, while maintaining the EBRD’s overall private sector focus.

- Deepening policy dialogue: by working closely with local and national authorities, the EBRD is able to support and influence investment plans, legislation and other policy interventions that can stimulate the transition to and growth of a low-carbon economy.

The GET model

The GET approach uses the full range of the EBRD’s financial instruments, including:

- direct EBRD financing and syndication through private, non-sovereign and sovereign-guaranteed loans, direct equity, equity funds and credit lines to local financial institutions which on-lend funds to small and medium-sized enterprises (SMEs), the residential sector and other investors for sustainable energy and resource projects

- co-financing with the private financial sector, public sources such as multilateral donor funds, and other international financial institutions as part of the project financing plan

- selective and intelligent use of subsidies to address specific barriers to market in line with the Bank’s guidelines

- carbon finance or other market-based systems which can provide additional revenue for projects (such as technical support)

- project preparation support in the form of technical assistance

- project-related capacity building and policy dialogue to support implementation of projects and to pave the way for future innovation.

All of the projects we invest in are assessed for their potential impact during the Bank’s development and approval stages. All project-related data are subject to the Bank’s monitoring, reporting and verification framework. It has a robust accounting mechanism under which the finance provided to and the outcomes generated by these projects can be tracked and reported on.

151

Number of projects under the GET approach

2.9

Investment volume

(€ billion)

29

PJ annually in energy savings

1,115

Renewable power generation

GWh annually

5.2

CO2 emission reductions

million tonnes CO2 annually

We also work with other multilateral development banks (MDBs) on a common methodology to track financial flows dedicated to climate change mitigation and adaptation. The latest joint report was published in August 2016.

How is GET working in practice?

The GET activity has been well distributed in regional terms. Cumulative financing in (i) south-eastern Europe; (ii) eastern Europe and the Caucasus; (iii) Russia; and (iv) central Europe and the Baltic states was €3.9, €3.6, €3.2 and €3.6 billion, respectively, with cumulative financing in Turkey rising to €3.9 billion since the start of operations there in 2009.

The highest cumulative number of GET operations has been in south-eastern Europe and in eastern Europe and the Caucasus at around 250 each. The number of operations in Central Asia reached 109, the same as in central Europe and the Baltic states. In terms of cumulative carbon emission reductions, the regions with the largest reductions are Russia, eastern Europe and the Caucasus (reflecting particularly strong activity in Ukraine) and central Europe and the Baltic states.

The transition to a green economy affords numerous opportunities for growth. See our Stories section for more on how EBRD clients and countries who have taken steps to combat climate change and move towards a low-carbon future under our GET approach are reaping considerable economic, environmental and social benefits.

DIRECT LENDING

The EBRD has developed a strong direct lending activity to drive industrial energy efficiency targeting, for example, energy-intensive industries in the steel, cement and petrochemical sectors. The Bank also provides direct finance to clients in the municipal sector and the energy sector who wish to invest in green projects.

Direct lending under the GET reached €2.4 billion in 2016. At the project level, this involves close work with private sector industrial companies to introduce cost-effective energy and resource efficiency measures and modernise manufacturing processes. Specific investments include waste heat recovery, waste minimisation, and on-site heat and power generation.

Beyond individual corporates, the EBRD has also developed sector-specific approaches to enhance energy efficiency and define low-carbon pathways for individual energy intensive sectors, such as, for example, the cement sector in Egypt (see Policy dialogue).

To overcome specific information and technical barriers, the EBRD supports its clients when needed with energy audits and/or feasibility studies. Energy audits include a benchmark analysis, a risk assessment, a capital investment appraisal and an implementation plan. Specialised consultants are commissioned to carry out these audits, which includes on-site assessments and the analysis of energy management practices.

One example of the Bank’s initiatives in this area is the Finance and Technology Transfer Centre for Climate Change (FINTECC) programme, which helps companies implement cutting edge technologies that reduce greenhouse gas emissions, water, energy or material consumption or assist clients in becoming more resilient to the effects of climate change. The programme is funded by the GEF, the European Union and the EBRD’s Shareholder Special Fund.

The objective of FINTECC is to raise awareness of the innovative technologies available which have significant carbon reduction benefits but have not yet become popular in the countries where we invest, and to help spread their use through grants, policy dialogue and technical cooperation.

Since the launch of the FINTECC programme, 28 projects have been signed which include a FINTECC component.

In 2016, the programme was launched in Ukraine. In the same year, the EBRD, FAO and the IEA published a methodology that helps countries assess the market penetration of climate technologies and supports the transfer of best practice. The methodology was successfully piloted in Morocco, Kazakhstan and Belarus.

IN ACTION

SUSTAINABLE ENERGY FINANCE FACILITIES

The EBRD’s Sustainable Energy Finance Facilities (SEFFs) programme extends credit lines to local financial institutions for on-lending to their clients from the industrial, commercial, residential and municipal sectors for investments in energy efficiency and small-scale renewable energy projects. *

The EBRD operates its SEFFs through a network of more than 100 local financial institutions (banks, microfinance institutions and leasing companies), providing around €500 million in credit lines for sustainable energy projects per year.

The EBRD’s SEFFs have now been extended to 24 countries.

In 2016, in line with GET, the EBRD expanded the scope of the MidSEFF III and TurSEFF III facilities in Turkey to include resource efficiency components.

TurSEFF

The Turkey Sustainable Energy Financing Facility (TurSEFF) is a credit line developed by the EBRD in 2010 for industrial and commercial small and medium-sized enterprises (SMEs) that plan to invest in energy efficiency or renewable energy projects.

In December 2016, the EBRD announced it would be providing a new €400 million financing package for small-scale renewable energy and resource efficiency projects in Turkey under the next phase of TurSEFF.

This extension builds on the success of the first two phases of the facility, with €600 million already provided by the EBRD, the European Investment Bank and the Japan Bank for International Cooperation to Turkish partner banks. The new extension will include, for the first time, leasing companies in addition to banks and will also be available for municipal projects.

Almost half of the EBRD’s projects in Turkey promote the use of sustainable energy. Since 2009 the Bank has invested over €3.5 billion in more than 90 such projects, including two of Turkey’s largest wind farms and its largest geothermal power plant (which is also the second largest in Europe).

The EBRD has also helped develop Turkey’s first National Renewable Energy Action Plan to attract more investment in renewable energy projects. In addition, it has supported the preparation of a National Energy Efficiency Action Plan which covers a wide range of sector-based resource efficiency measures aimed at achieving Turkey’s 2023 energy efficiency targets.

MidSEFF

Under the Mid-size Sustainable Energy Financing Facility (MidSEFF), funds are provided to Turkish banks in the form of loans and capital market instruments for on-lending to private sector companies. MidSEFF was launched in 2011 and has financed 43 projects through seven Turkish banks so far. The facility has helped build over 800 MW of additional renewable energy capacity, representing a major step for Turkey towards its goal of developing 30 per cent of total installed capacity from renewable sources by 2023.

In 2016, the EBRD committed a further €500 million to MidSEFF, bringing the total funds under the facility to €1.5 billion. The financing – supported by the and the – will benefit renewable energy and resource efficiency projects in Turkey including solar, hydropower, wind, geothermal, waste-to-energy and energy efficiency as well as water saving and waste minimisation projects.

IN ACTION

Green trade

Following the extension of the Bank’s Trade Facilitation Programme (TFP) approved by the EBRD Board in May 2016, the Bank has started implementing the Green TFP initiative. The Green TFP is a marketing initiative to accelerate distribution and up-take of high performance technologies and services supporting GET.

Improved understanding of the potential and demand for GET technologies and services in the countries of operations unlocks new investment and business development opportunities for local financial institutions and businesses (buyers of imported GET technology and their manufacturers, suppliers and service providers).

Over the course of 2016, the Green TFP has contributed more than €110 million in GET financing. More than 200 Green TFP transactions have been financed in 14 EBRD countries of operations, resulting in annual energy savings of 339,750 MWh, water savings of 26,300m3 and emission reductions of 181,600 tCO2. These have ranged from the import of energy-efficient processing equipment to Cyprus and greenhouse equipment to Armenia; the export of energy-efficient stoves and fireplaces from FYR Macedonia to the Slovak Republic; as well as transactions supporting resource efficiency, such as the import of water-saving taps to Serbia from Slovenia.

CLIMATE RESILIENCE INVESTMENTS

The Bank signed 36 climate resilience investments in 2016 worth a total of €186 million. These ventures helped clients to become more resilient to a changing and more variable climate.

2016 has revealed a new market trend of many major stakeholders – such as the International Hydropower Association and the World Road Association – taking climate resilience considerations on board. The EBRD is actively involved at the forefront of these developments. We have taken a leading role in the European Financing Institutions Working Group on Adaptation to Climate Change, a partnership involving the Agence Française de Développement (AfD), the Council of Europe Development Bank (CEB), the European Commission’s Directorate-General for Climate Action (DG CLIMA) , the European Investment Bank (EIB), KfW Development Bank (KfW) and the Nordic Investment Bank (NIB). This year the group launched its publication “Integrating Climate Change Information in Adaptation Project Development” which has already received significant interest from commercial banks.

The EBRD also supported the first-ever carbon neutral hydropower project in Georgia with a contribution of US$ 80 million to the new hydroelectric power plant which was constructed on the Tergi river, in the Kazbegi region. To balance the plant’s carbon and greenhouse emissions associated with its construction and operation, an ambitious reforestation programme was launched to plant and grow a forest in the river basin that feeds the hydropower scheme.

The EBRD has also assisted the World Association for Maritime Transport Infrastructure (PIANC) in developing its industry guidelines on climate resilience.

IN ACTION

CLIMATE FINANCE PARTNERSHIPS

The EBRD’s climate finance partners provide crucial funds to support our policy dialogue efforts and the facilitation of technical expertise to clients. When market barriers are very high, these partners also step in and provide capital expenditure grants or concessional finance, which is combined with the Bank’s commercial finance. This way, the Bank can overcome market barriers, such as the limited availability of state-of-the-art technologies and affordability constraints, which ultimately facilitates the creation of new markets.

The EBRD implements some projects with support from donor funds such as the Climate Investment Funds (CIF) and the Global Environment Facility (GEF). These multilateral funds seek to augment global climate finance through risk sharing, technology transfer, policy dialogue, advisory support and concessional financing.

In October 2016, the Board of the Green Climate Fund approved an allocation of US$ 378 million to support the EBRD’s green investments under the GET approach aimed at reducing emissions and combatting climate change. This is the Fund’s largest approval to date and a gratifying endorsement of the Bank’s work in this area.

The Green Climate Fund was created in 2010 under the United Nations Framework Convention on Climate Change (UNFCCC). It allocates its resources to low-emission and climate-resilient projects and programmes in developing countries.

This contribution to the EBRD’s work will support the sustainable energy financing facilities the Bank offers in Armenia, Egypt, Georgia, Jordan, Moldova, Mongolia, Morocco, Serbia, Tajikistan and Tunisia.

Also at COP22 in Marrakesh in November, the Bank, together withthe Union for the Mediterranean (UfM) , launched the SEMED Private Renewable Energy Framework (SPREF), a €227 million financing framework aimed at the development of private renewable energy markets in Egypt, Jordan, Morocco and Tunisia.

SPREF will help the region reduce its heavy dependence on imports of hydrocarbons. It aims to mobilise additional investment from other parties, including the Climate Investment Funds’ Clean Technology Fund (CTF) and the Global Environment Facility (GEF), of up to €834 million.

POLICY DIALOGUE AND INTERNATIONAL ACTION ON CLIMATE CHANGE

A key component of the EBRD’s GET approach is working together with governments to support the development of strong institutional and regulatory frameworks to incentivise the transition to a low carbon economy and the sustainable use of resources.

A key component of the EBRD’s GET approach is working together with governments to support the development of strong institutional and regulatory frameworks to incentivise the transition to a low carbon economy and the sustainable use of resources.

2016 began with the process towards ratification of the Paris agreement which was adopted by consensus at the COP21 conference in December 2015. The impact of the agreement has been significant in that it has provided a major platform for further international consensus and accountability, as well as capacity-building, when it comes to tackling climate change. The agreement placed a major emphasis on the transfer of finance to support climate investments in emerging and developing economies.

Throughout the past year the EBRD has contributed to this undertaking by formally rolling out its GET approach and encouraging the countries where we invest to mitigate climate impacts based on the application of international best practices and changes in regulations where necessary.

The Bank played an active role in the COP22 conference in November 2016 and organised a number of events as well as participating in other meetings. As this COP was in Morocco, an EBRD country of operations, the Bank took the opportunity to profile its energy-efficiency work in the country and the region and showcased the Morocco Sustainable Energy Financing Facility (MorSEFF) which has been extended to two commercial banks in Morocco, BMCE and BCP.

With its investments the EBRD will support the countries where it invests to implement their Intended Nationally Determined Contributions (NDCs) under the Paris agreement. The sustained focus of the Bank’s investment is on energy efficiency improvement in cities, industries and utilities where the fastest carbon emission reductions can be achieved. The EBRD is also increasing its activity in climate adaptation financing.

IN ACTION

THE EBRD AND THE SUSTAINABLE DEVELOPMENT GOALS

The Sustainable Development Goals (SDGs) reflect a shared global vision of progress to transform societies and economies towards a safe, equitable and sustainable future. The goals of sustainable consumption and production, sustainable energy and combating climate change have been identified as the three most transformational challenges to relieve the overall anthropogenic pressures on the planet and its natural systems. The GET approach supports the EBRD’s countries of operations to implement the SDGs in the following areas:

- SDG6: ensuring availability and sustainable management of water and sanitation

- SDG7: access to affordable, reliable, sustainable and modern energy

- SDG8: promoting sustained, inclusive and sustainable economic growth through improving resource efficiency in consumption and production

- SDG9: redevelopment of industries and infrastructure with increased resource use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes

- SDG12: promoting sustainable consumption and production patterns through supporting progress on energy efficiency, renewable energy generation and on waste management and recycling

- SDG13: combating climate change.

GREENHOUSE GAS ASSESSMENT FOR 2016

Our Greenhouse Gas Assessment provides an estimate of the net carbon footprint that will result from EBRD-financed projects signed during a representative year, once the projects are fully implemented. The calculation is based on estimated emission reductions from sustainable energy projects and estimates of “new” greenhouse gas (GHG) emissions from projects that involve new building or expanding capacity.

The EBRD has published GHG estimates for its signed projects every year since 2002.

All new projects are screened and those with potentially significant GHG impacts – either emission savings or increases beyond a threshold of 25 ktCO2e per year – are subject to a more detailed assessment. The assessment also estimates the projected GHG savings that will result from smaller energy efficiency and renewable energy projects that we finance through targeted credit lines managed by financial intermediaries.*

GHG data for the project assessments come from a variety of sources, including environmental impact assessments (EIAs), energy audits and, in some cases, calculations carried out by our engineers.

GHG numbers

| Category | Number of investments above significance threshold | GHG impact (ktCO2e per year) |

|---|---|---|

| Renewable energy | 9 | -870 |

| Energy efficiency | 17 | -2,410 |

| Climate mitigation funds and credit line | 3 | -300 |

| Greenfield (new build) | 3 | 230 |

| Total | 32 | -3,350 |

2016 marks the 11th consecutive year in which our investments have been forecast to deliver aggregate GHG savings. The results of the 2016 GHG assessment show that, as in previous years, by prioritising investments in renewable energy, energy efficiency and now the broader green economy, we have been able to promote transition while also reducing overall GHG emissions.

Notable projects from this year have included the Erdemir Steel project in Turkey and in Jordan, the replacement of an old oil-fired thermal power plant with a highly efficient Closed-Cycle Gas Turbine (CCGT) plant will reduce emissions by an estimated 480,000 tonnes each year, as well as improving local air quality by lowering emissions of sulphur dioxide and particulates. In 2016 the Bank financed just three projects that will produce CO2 increases above the annual 25,000 tonnes reporting threshold, all of which were in the mining sector. This compares with 29 projects that will lower CO2 emissions by more than 25,000 tonnes per year. This reflects the EBRD’s increased emphasis on identifying and supporting projects that contribute to “greening” the economies of our countries of operations.

TRANSPORT

The EBRD supports the development of safe and sustainable transport systems which balance the economic, environmental and social needs of the countries where we invest.

The EBRD supports the development of safe and sustainable transport systems which balance the economic, environmental and social needs of the countries where we invest.

Transport is a vital component of our work. It drives development, links people, builds markets, facilitates trade and connects local communities to the world. In turn, sustainable transport leads to sustainable development, which is fundamental to meeting the needs of both current populations and of future generations.

Sustainable transport is also key to achieving the Sustainable Development Goals of inclusive growth, job creation, poverty reduction, access to markets, the empowerment of women, and the well-being of persons with disabilities and other vulnerable groups. It is also essential to our efforts to fight climate change, reduce air pollution and improve road safety.

Given the strategic importance of the transport sector for sustainable development and in line with our endorsement of the joint MDB commitment for Sustainable Transport issued at the UN Conference on Sustainable Development in 2012 (Rio+20), the EBRD has increased its impact in terms of volume of financing, coverage of sectors, emission reductions, policy dialogue and innovative financing instruments over the recent years.

In 2016 we signed 23 transactions in the transport sector for a total EBRD investment of €1.01 billion, including the promotion of inland water transport and rail infrastructure in the Western Balkans, the expansion of port capacity grain exports in Ukraine and investments in mass and public transport in various other cities across our region.

The Bank continues to successfully scale up green transport investments by going beyond providing finance for projects – we combine investments with technical cooperation and policy dialogue, creating a blueprint for sustainable development that extends beyond our current projects.

Our work in Bosnia and Herzegovina in creating safer and more resilient roads is an example of this. We support “top-down” policy-making – that is, supporting the implementation of policies which create an environment that fosters sustainable projects – and also “bottom-up” evidence-based policy-making, where experience from projects is fed back to governments and the investor community to help remove real barriers to the further growth of a sector, such as through the publication of policy papers about automated fare collection systems in public transport, or organising seminars about green logistics.

The Green Logistics Programme

The growth of transport demand shows the importance of decarbonising the transport chain to tackle climate change. With the support of the Global Environment Facility (GEF), in 2016 we launched the Green Logistics Programme (GLP) which takes a strategic approach to address carbon emissions from the transport sector and encourage major players to introduce best practices in carbon reduction to combat both the region’s and the sector’s persistent reputation of highly inefficient energy use.

Innovative solutions such as increasing use of intelligent transportation systems, last-mile logistics, modal shift to lower carbon transport modes, green packaging, green warehousing and other best practices are all possibilities for our transport clients under the GLP.

Improving road safety

The EBRD invests in many projects to improve road safety. In 2011 the EBRD joined other MDBs in establishing an MDB Road Safety Initiative to increase road safety activities. Since then, the Bank has increased its financing of road safety improvements, mobilising over €2 million of technical assistance for road safety audits, capacity building, policy and institutional development and awareness events. In 2016 alone we raised €400,000 from the EBRD Shareholder Special Fund for the development of a traffic accident database in Bosnia and Herzegovina and we launched an initiative of knowledge-sharing among MDBs on the topic of occupational road safety.

See also Health and Safety.

Automated Fare Collection (AFC) systems

Cities are increasingly recognising that efficient fare collection is a key component in providing sustainable public transport services. AFC systems are an essential part of a modern public transport system through improved user services of easier payment access, real time information and service responsiveness. These systems work best in integrated public transport networks with enhanced user information and fare products to encourage increased usage. The EBRD encourages cities to adopt such systems and is currently developing knowledge platforms and dissemination tools, notably an AFC policy paper and seminars.

Since 2013, the EBRD has invested €72 million in developing modern AFC systems in Budapest and in the Ukrainian cities of Vinnytsia and Lviv, based on design, build and maintain (DBM) contracts between the city authorities and private AFC system providers. Loan proceeds are used to finance AFC system fixed assets, travel media, software installation and maintenance services with additional local contributions for project management and marketing. The systems encourage financial sustainability through increased ticket sales, reduced cash leakage and lower operating expenses.

IN ACTION

MUNICIPAL AND ENVIRONMENTAL INFRASTRUCTURE

The EBRD’s work in the municipal and environmental infrastructure (MEI) sector provides millions of people with access to safe drinking water, sanitary waste disposal services, green public transport, well-maintained urban roads and energy-efficient district heating. We work with local governments, private operators and donors to bring tangible improvements to the lives of citizens in the countries where we invest.

In 2016, we financed 50 projects across 18 countries in the MEI sector, representing a total EBRD commitment of €663 million. These investments are expected to benefit a total of 24 million people in the EBRD region through provision of improved water services, district heating, solid waste facilities and other municipal infrastructure. In addition, over 855,000 people are expected to use on a daily basis public transport systems which have been upgraded and made more efficient with our support. Around 80 per cent of these investments were supported by the Bank’s Green Economy Transition (GET) initiative leading to predicted emission reductions estimated at 358,000 tCO2e a year.

As in previous years, our MEI investments leveraged considerable volumes of loan and grant co-financing from commercial banks, the European Union (EU) and other sources, to a total of €664 million in mobilised co-financing.

Green Cities Programme

Cities in the EBRD region face common challenges in their attempts to reduce their energy and carbon intensity, as well as a pressing range of environmental and social issues from the impacts of climate change to the deteriorating health and well-being of citizens due to poor air quality.

The need to act to make cities greener is also acknowledged globally. Goal 11 of the UN Sustainable Development Goals is to “make cities and human settlements inclusive, safe, resilient and sustainable”.

In response, the EBRD has developed the Green Cities Programme (GrCP). The GrCP builds on the EBRD’s two decades of experience investing in municipal and environmental infrastructure – representing over €700 million and 800,000 tonnes of CO2 mitigated annually and multiple local environmental benefits.

Using this experience, the programme will apply the EBRD’s business model, combining bankable investments with technical cooperation and policy dialogue.

The Green Cities Programme is being piloted in Georgia, Armenia and Moldova, with a Green Cities Framework approved by the EBRD Board of Directors in November 2016.

IN ACTION

GENDER EQUALITY

Addressing inequality, whether gender-related or otherwise, is not just a moral imperative but a prerequisite for well-functioning market economies, as well as equitable and sustainable growth.

The EBRD region is diverse and, compared with other regions, significantly more prosperous. While some countries enjoy a relatively strong participation of women in the economy (in fact, female labour force participation rates in some countries in Central Asia are higher than in the West), others such as the SEMED region have the lowest female labour force participation in the world. However, significant disparities in pay, choice and access to employment persist, even in countries with strong participation. This is coupled with women performing a disproportionately higher share of unpaid work and gender-biased laws in many EBRD countries which restrict women’s choice of trade or profession in different ways. Gender disparities are also evident in leadership roles, legal status and rights.Strategy for the Promotion of Gender Equality – now in its first year of implementation – commits to “mainstream” gender into the EBRD’s operations by 2020 and identifies three core areas of intervention: access to finance, access to employment and skills and access to services.

Working closely with public and private sector clients, the EBRD supports the creation of economic opportunities specifically targeting women, improving their access to finance and services, and enhancing the quality of, and opportunities within, employment.

In 2016, the Bank signed 29 projects with either a gender focus or component.

Almost 50 per cent of these projects relate to the Bank’s Women in Business Programme, which was developed to address the challenges faced by women entrepreneurs by boosting access to finance and know-how. Currently active in 16 countries, these programmes offer a whole range of complementary services to women-led SMEs in addition to much-needed finance to operate and grow their businesses (the global gender credit gap is estimated at US$ 285 billion).*

Access to credit through local financial institutions is combined with technical assistance to help those institutions provide lending solutions that are tailored to the needs of women-led businesses. Credit enhancement and risk-sharing mechanisms are also in place, with the hope that once the differential between perceived and real risk is documented, women-led firms will no longer face unjustified higher financing costs.

In response to employment gaps in the countries where we invest, approximately 40 per cent of those projects with a gender component contributed towards supporting women’s increased access to employment and skills. With a particular focus on traditionally male-dominated sectors, such as extractive industries, transport and power and energy, the EBRD has worked closely with its clients to support the diversification of their workforces and, importantly, contribute to addressing issues of retention, motivation and progression.

In terms of access to services, particularly in the area of infrastructure development, the Bank actively supports projects to improve women’s mobility and to facilitate access to basic services, as well as economic and educational opportunities. As an example, the Bank has been actively engaged in the preparation of gender components in urban transport projects throughout 2016.

The EBRD has also continued its dialogue with government partners during 2016 on legal reforms to promote gender equality and address legal and regulatory bottlenecks for women’s participation in the economy.

The EBRD’s work promoting gender equality benefits significantly from the generous support of its donors, much of which is channeled through the EBRD’s Gender Advisory Services Programme with support from the EBRD Shareholder Special Fund (SSF), the EBRD Japan-European Cooperation Fund and the EBRD Taiwan Fund.

In 2016, there were 13 donor-funded commitments totaling in excess of €1 million for gender activities linked to investments, to the creation of enabling environments and to broader initiatives to address other global challenges, such as the EBRD’s refugee response.

IN ACTION

ECONOMIC INCLUSION

Economic inclusion is one of the EBRD’s key priorities and we are a leading IFI in this area based on our private sector-led approach.

Economic inclusion means opening up economic opportunities to previously under-served social groups – especially in relation to youth, gender and populations in less-advanced regions – which is integral to achieving the transition to sustainable market economies.

Throughout 2016 we have helped our clients diversify their workforces, address skills shortages or mismatches, and create jobs in previously inefficient or under-resourced sectors, bringing tangible benefits to their businesses and the wider communities in which they operate.

Project progress and achievements

In 2016 the EBRD signed 22 projects with inclusion components, representing a total investment volume of €0.92 billion.

Projects have ranged from a new retail complex in Amman, Jordan which involved opening a dedicated on-site training and recruitment centre for young people; projects in manufacturing, agribusiness, and mining sectors that provide career progression for young people, women and populations in disadvantaged regions of Egypt, Kazakhstan and Turkey; a private-sector led youth initiative to address skills mismatches in Croatia; Women in Business programmes in Armenia, Belarus, Georgia, Kazakhstan and FYR Macedonia; and support for inclusive tourism, particularly in the SEMED region.

In Turkey, a Memorandum of Understanding was signed with the Ministry of National Education to facilitate private-sector participation in setting technical and vocational education training skills standards, increasing the availability and quality of work-based learning opportunities, and supporting youth employment through targeted career guidance. Of all the countries where the Bank invests, Turkey has the most inclusion projects and is most advanced in terms of inclusion policy dialogue.

IN ACTION

SPECIAL ENVIRONMENTAL PROGRAMMES

Eastern Europe Energy Efficiency and Environment Partnership

The Eastern Europe Energy Efficiency and Environment Partnership (E5P) is a multi-donor fund established in 2010 and managed by the EBRD’s Environment and Sustainability Department. The purpose of the fund is to facilitate investment in energy efficiency and environmental projects, reduce greenhouse gas emissions and promote policy dialogue and regulatory reforms in E5P countries.

The E5P mainly provides investment grants to co-finance municipal sector loans provided by the EBRD and other participating international financial institutions.

The E5P’s initial focus has been Ukraine, with total pledges nearing €109 million, including funds from the European Union (€40 million) as the largest contributor. Other contributors include Sweden, Ukraine, the United States of America and 16 other countries. In 2016, the E5P contributed to three major projects in Ukraine.

IN ACTION

The E5P has now expanded to include Armenia, Georgia and Moldova. Belarus has also expressed its intention to join the E5P.

In April 2016, the EBRD signed a sovereign loan deal with Armenia for €2 million to introduce modern solid waste management solutions in the Kotayk and Gerarkunik regions of the country. This investment is supported by a €2 million grant from E5P. The new landfill to be constructed will be the first in Armenia to comply with EU regulations and will operate as a commercial unit. The services will generate major environmental and social benefits for some 500,000 inhabitants.

Also in 2016, E5P in Moldova received several new proposals for co-financing.

Northern Dimension Environmental Partnership

The Northern Dimension Environmental Partnership (NDEP) is a multi-donor fund that was established in 2002 and is managed by the EBRD. Total contributions to the fund are €348 million.

The fund is split into two windows. In the first, the EBRD’s Nuclear Safety Department is using grant funds provided by NDEP contributors (€166 million) to tackle risks caused by radioactive waste deposited in the north-west of Russia. The nuclear safety projects within NDEP are fully grant financed. Currently the work is focusing on the removal operations of Spent Nuclear Fuel (SNF) from Andreeva Bay and from the Lepse ship based at the Nerpa shipyard near Murmansk.

The EBRD’s Environment and Sustainability Department manages the environmental window of the fund, promoting municipal sector projects for water and wastewater treatment, energy efficiency and municipal waste management in north-western Russia and northern Belarus. The NDEP funds for environmental projects total €182 million and are used as co-financing to support loans from the EBRD and other NDEP-approved implementing agencies.

In 2016 the EBRD extended a sovereign loan to Belarus of €15 million to upgrade wastewater treatment facilities in Lida and Polotsk. NDEP is co-financing these investments with grants of €7.21 million which were also signed in 2016. Once implemented, the wastewater treatment will be compliant with HELCOM standards and will significantly reduce the phosphorous and nitrogen discharges to the Baltic Sea to prevent the eutrophication of the sea.

In Russia, several large wastewater treatment projects are nearing completion, one of them is the Neva Programme in St Petersburg. This project has been a huge undertaking for NDEP, worth close to €563 million. Thanks to cooperation with NDEP, St Petersburg has raised the level of wastewater treatment in the city to over 94 per cent. Moreover, as of November 2016 the EBRD and NDEP co-financed Kaliningrad wastewater treatment plant is working in compliance with HELCOM standards.

DONOR PARTNERSHIPS AND SUSTAINABLE GROWTH

Donor partnerships have been supporting the EBRD’s model of sustainable development from the Bank’s very beginnings. Thanks to over 30 bilateral donors, including governments and development agencies, as well as multilateral institutions, the European Union, global funds, private sector firms and foundations, the EBRD is able to have a more sustainable impact in the countries where it invests, benefiting both the environment and local communities, and improving millions of lives.

Donor partnerships have been supporting the EBRD’s model of sustainable development from the Bank’s very beginnings. Thanks to over 30 bilateral donors, including governments and development agencies, as well as multilateral institutions, the European Union, global funds, private sector firms and foundations, the EBRD is able to have a more sustainable impact in the countries where it invests, benefiting both the environment and local communities, and improving millions of lives.

Donors make so many of the EBRD’s sustainable investments possible by supporting the Bank’s work with co-financing grants. For example, all of the Bank’s sustainable energy financing facilities, which provide funds for energy efficiency investments, benefit from donor support. Donors also fund technical cooperation activities which can complement investments by improving local skills so that projects are managed on the ground to the highest standards, creating a legacy of best practice and creating new expertise.

In the municipal and infrastructure sector, for example, donor funds very often make investments in improvements to municipal services such as water utilities and public transport happen where local and EBRD funds alone would not be sufficient. They also enable the hiring of expert consultants to assist the municipal companies in making the best use of the EBRD’s finance and donor grants.

In 2016, more than 60 per cent of donor-funded grants were used to enable investments in the municipal infrastructure, transport and energy sectors and to support the Bank’s Green Economy Transition agenda.

Donor-funded technical assistance is not limited to just supporting investments. Many of these assignments are designed to tackle systemic issues which create obstacles for the long-term economic growth of the countries where the EBRD invests. For this reason, donors support projects in a range of areas including legal reforms; economic and gender inclusion; environmental and social issues; anti-corruption initiatives; policy dialogue activities; and field-specific studies.

Donors in 2016 provided more than €23 million to strengthen governance at national and corporate levels and to improve the investment climate. They also provided more than €7 million to promote economic inclusion and gender equality in countries where the EBRD invests.

Donor support is and will continue to be crucial to making our work more sustainable.

Read more about donor stories at the Donors and the EBRD microsite.